ev tax credit bill point of sale

Cars assembled in North America can qualify for up to 7500 in federal EV tax credits 3750 if the battery components were built. For ebike cost 500-999100.

Automakers Concerned Over Consumer Access To Ev Tax Credit In Senate Proposal Automotive News

The deal includes a cap on the suggested retail price of eligible vehicles of 55000 for new cars and 80000 for pickup trucks SUVs and vans.

. Credits would be capped to an. The full EV tax credit will be available to individuals. This means a rebate right up front instead of at the end of the fiscal year also in 2024 a 4000 rebate will be.

Its called the Inflation Reduction Act and among a long list of new legislation backed by 374 billion in climate and energy spending it includes an updated 7500 electric. Sedans more expensive than 55000 and SUVs and Trucks more expensive than 80000 are not eligible for the credit. Of this 125 percent goes to the applicable county government.

The tax credit can now be applied at the point of sale. 2 days agoPerhaps the most impactful is that it dramatically reduced the number of electric vehicles that qualify for a 7500 federal tax credit. The rules for used EVs also take effect on January 1 2023 and are.

The language in the bill indicates that the tax credit would be implemented at the point of sale instead of on taxes. Alameda Municipal Power AMP 10-20 rebate for new ebike purchase up to 300 20-40 up to 600 for low income Tiered rebates. In 2024 the plan is to implement tax credit at the point of sale.

The change would move the tax credit much closer to a point-of-sale incentive and with the right qualifying EV buyers could receive a max of 12500 back from the. Part of a 369 billion package of bills addressing climate. Electric trucks vans and SUVs would have an 80000 cap and cars would be capped at 55000.

The federal climate bill signed by President Biden this summer includes a 7500 tax credit for buying a new electric vehicle and a 4000 credit for buying a used EV. The new tax credits replace the old incentive. It will bring the tax credit back for Tesla GM Toyota and all other EV automakers but only if.

According to the Sales Tax Handbook the California sales tax for vehicles is 75 percent. If passed by the Senate the measure would still need to survive a vote in the House of Representatives to be enacted. Now a new bill that would reinstate.

Simply put the Inflation Reduction Act includes a 7500 tax credit at the point of sale for new EVs and 4000 for used EVs. All-electric car sales in California grew only 5 in 2019 to 99704 according. The 200000 sale cap is replaced with an expiration date of December 31 2032.

On January 1st used EVs priced 25000 or less will be eligible for a 4000 tax credit or 30 of the sales price whichever is lower. How much is the electric car tax credit. EV tax credit extension with 7500 point-of-sale rebate 4000 for used EVs could pass Senate soon Half of households might need a costly panel upgrade to use a Level 2 EV.

The tax credit for used EVs will be calculated at either 30 of the vehicles value or 4000 whichever is less. Individuals who make up to 150000 annually would be eligible for the. Used EVs will get a tax credit.

LAEDC also recommends that tax credits around 5 be considered for EV-related manufacturers.

Exclusive U S Automaker Ceos Toyota Urge Congress To Lift Ev Tax Credit Cap Reuters

Can Ev Tax Credit Survive Senate Industry Objections Automotive News

How The New Ev Tax Credit Will Affect Your Auto Loan Auto Loans And Advice U S News

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

A Made In America Ev Tax Credit What Car Buyers Need To Know If Biden Can Advance A Sliced And Diced Build Back Better Bill Marketwatch

U S Automakers Say 70 Of Ev Models Would Not Qualify For Tax Credit Under Senate Bill Reuters

The New Ev Tax Credit Bill Is A Misunderstood Blessing For Americans Here S What S What

If You Want An Ev Buy Now Rivian Fisker And Others Rush To Lock In Ev Tax Credits Before Changes Electrek

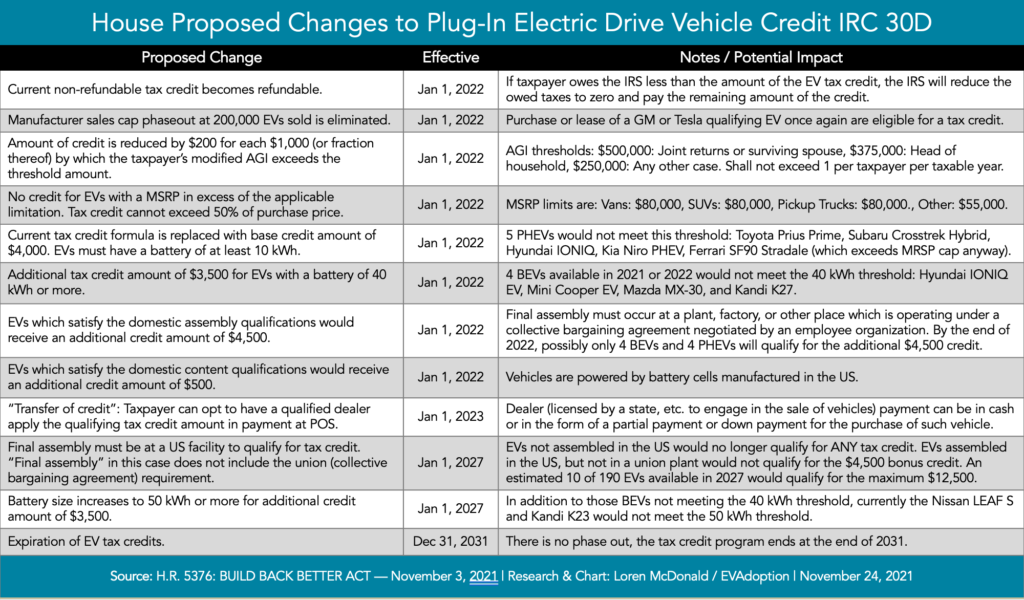

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption

Conn Ev Rebate Reforms Include Point Of Sale Vouchers Energy News Network

The New Federal Tax Credit For Evs

What To Know About The Electric Vehicle Tax Credits And How To Get More Money Back Wsj

Toyota Has Run Out Of Ev Tax Credits Toyota Bz Forum

Ev Tax Credits Are Changing What S Ahead Kiplinger

Ev Tax Credits Are Not Retroactive Here S Why Youtube

Used Ev Tax Credits Are Here 8 Things To Know

Everything To Know About The Biden Administration S New Ev Subsidies The Week

The Inflation Reduction Act Discourages Electric Vehicle Buyers From Working

The U S Government Plans To Slice 7 500 Off Electric Car Prices But It S Complicated The Autopian